The Art of Slowing Down

142: 5,000 Audits? LVMH’s Fashion Crash & Cognac Trouble Deepen

As I wrote on July 23rd, 2025:

As I expected, on their earnings call yesterday evening, LVMH reported that their core fashion and leather goods business reported a steep decline in quarterly sales. Organic sales at the division declined by 9% in the second quarter. The drop was worse than analysts estimated, and the steepest decline reported by any of LVMH’s divisions. In fact, it seems to be the worst quarterly performance for the division in 25+ years.

In other numbers, LVMH’s revenue came in at -3%, profit from recurring operations -15% and operating margin at 22.6%. All of these numbers can be found here in their investor presentation and I’d like to focus on some specifics that I think are important and also what was left out along with what I’d imagine intentionally not addressed on the earnings call.

I don’t want to sound like a broken record however you can read my thoughts on the Loro Piana situation here and here. One would think that this would have been proactively addressed on an earnings call. Instead, investors had to wait for Carole Madjo from Barclays to ask the final questions of the session. She asked:

“Just 2 questions from my side. The first one, back on Loro Piana and the news flow you saw that the supply chain concern. Can you give us your take on the situation? How you're thinking about fixing this issue? And have you seen or do you expect to see some impact on the brand perception in the key markets?”

Cécile Cabanis’ reply was canned bullshit that I’d be surprised anybody buys (emphasis Intern Pierre):

“Thank you. So, on Loro Piana, we were not satisfied with the situation, especially because we've been working a lot since last year on reworking on all the processes, making sure that we had more audit in place. So, we've done like 5,000 audits last year (bullshit). And what happened in Loro Piana overall is a subcontractor of a supplier that was hidden from us (right ok…). So, we couldn't know, let's say. It's not that we cannot do better in terms of control, but we didn't know. And the day we knew we stopped the relationship with the supplier. This topic is beyond Loro Piana. It's a topic that the full industry in Italy is facing…”

So, you’re telling me that a company that purportedly is run with the precision of a Patek Philippe, after allegedly conducting 5.000 audits didn’t know? I’ll let you as the reader decide here as there seems to be a lot of “not knowing”, with this type of thing happening at Moët, Dior and now Loro Piana not once but twice in different geographies. We’re still waiting on the CEO of Loro Piana Frédéric Bernard Jean Étienne Arnault to say something given that he is the leader of Loro Piana and ultimately all successes, failures and problems rest with him.

Moving on to the rest of the presentation (which is visually assaulting and looks like it was designed by an Intern).

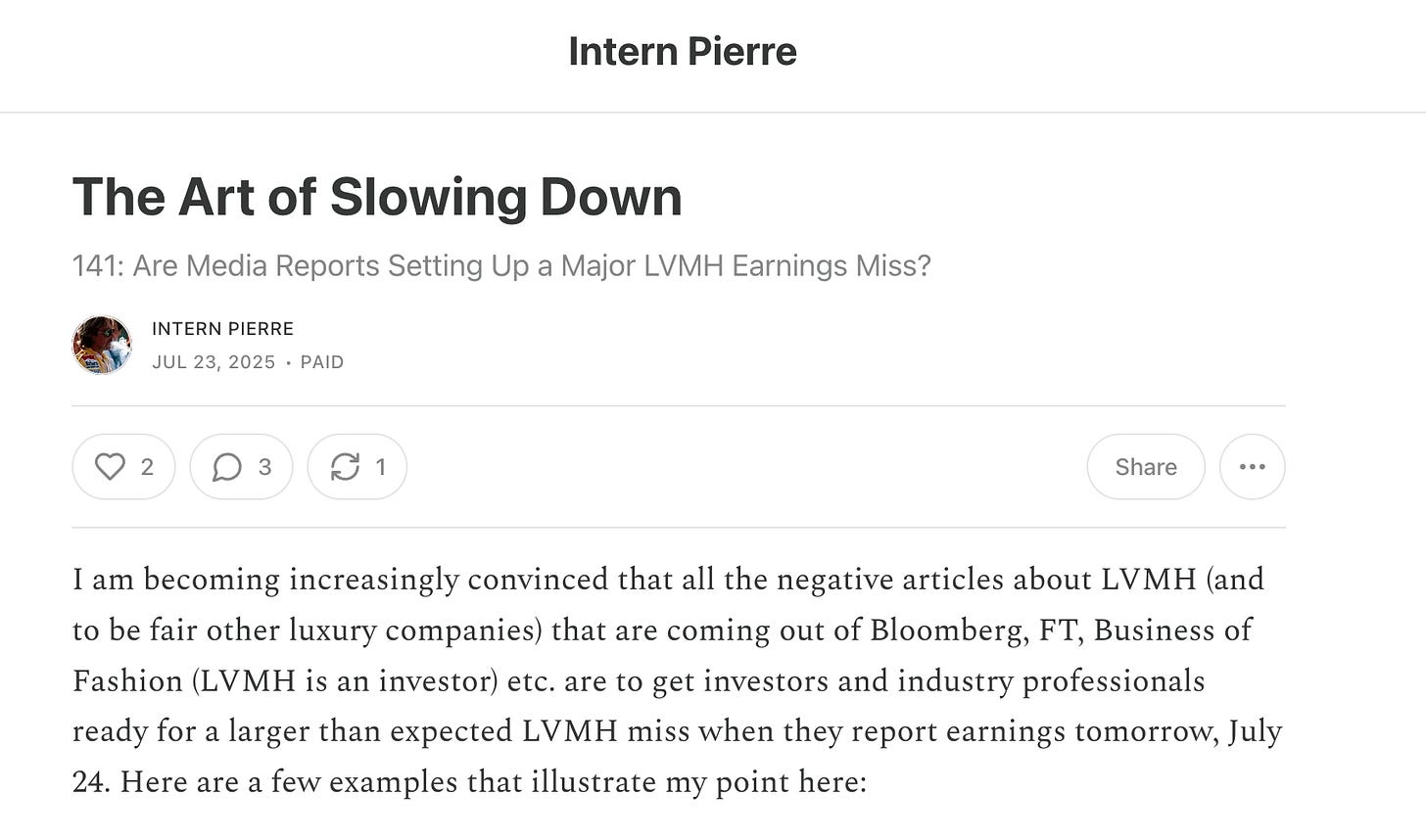

As I mentioned, revenue and profit for the Fashion and Leather Goods division was abysmal. In fact the performance was so bad that the slide on “positives” focused on sales to local (ie European) customers and creativity. I’ve included my notes and comments on the slide below:

I think the major takeaways here are that Pharrell isn’t working out and needs to be replaced as Men’s Creative Directors and that collaborations with individuals like Takashi Murakami (which was successful many years ago) are not working out well. I like the move by Dior of bringing Jonathan Anderson in as the Creative Director for both Men’s and Women’s and I think that will play out well in the long term. Based on store visits, industry expert interviews, surveys etc. the downward trend for the F&LG division isn’t going to turn around anytime soon. We’ll see what happens, however it seems irresponsible for Goldman Sachs to put LVMH on their “European Conviction Buy List” given the numbers that just came out from LVMH and the results of channel checks that could have easily been run.

Looking at the Wine & Spirits division, Moët Hennessy revenue from Champagne and Wines was up 2% on an organic basis and revenue for Cognac and Spirits was -15%.

The Cognac numbers are troubling because the company had previously reported a -17% number in their last earnings call. LVMH recently reported at 17% decrease in Cognac and other spirit sales. “Pierre, why is this a problem?” The issue here is that Cognac is a very high-margin product for Moët Hennessy so an additional 15% drop in Cognac and other spirit sales is a problem. Here is why the co-CEOs are still screwed.

The US market is one of the major markets for Cognac in the world (China is the number two). In the US many retails stores, think Walmart, Target, CVS, Total Wine etc. have issues with theft. Due to the three-tier distribution system in the United States when wine, beer, spirits etc. are stolen from these stores distributors do not provide coverage for theft because the distributor has already made the purchase from the manufacturer. This is unlike a Samsung TV where if it is stolen Samsung will generally account for some sort of reimbursement for stolen products.

In the US, in many cities, theft isn’t prosecuted, and retail workers are instructed to not take against people who are stealing. As a result, products like Hennessy need to be locked up as a deterrent for thieves and if a customer wants to purchase the product, they need to ask for a Sales Associates help. To use Cognac as an example, not all brands are locked up, however Hennessy is the majority of the time because it is a very commonly stolen item. As a result of this a customer looking to purchase a bottle of Hennessy may not want to wait up to five minutes for somebody to unlock the product and may simply opt for another brand.

Another headwind for Hennessy is that in the US the majority of their customer base is African American. This community has been impacted economically (as has the rest of the US consumer base). From research I have done and conversations I have had it seems like once Hennessy hits $37-$38 per bottle demand drops off a cliff resulting in customers to go with an alternative or brandy as a substitute. Who knows what is happening with tariffs in the United States as the situation changes almost daily, however if 20% tariffs are implemented on EU products like Cognac (it can only be produced in France) and the average cost per bottle in the US is around $34 now and a 20% tariff is implemented the cost of a bottle of Hennessy now increases by $6.80 to $40.80 which is higher than that cutoff number I mentioned above.

What also needs to be considered is the African American consumer’s move away from Hennessy and other Cognac in the US towards tequila. Tequila is on average less expensive than Cognac in the US coming in at $20-$25. This is going to be another headwind for Hennessy.

Industry experts I have spoken to have said that locking products like Hennessy will decimate demand for the product especially when other brands or tequila / other spirits are readily available.

I also like how the company keeps touting their partnership with Formula 1 however it seems like Laruent-Perrier has better availability than Moët!

Finally, LVMH CFO Cécile Cabanis noted that the changes to Moët Hennessy management will not be visible until next year. This is not a good thing for Alexandre Arnault who is on a very public two-year timeline to turn the division around. With the numbers continuing to drop he is going to need a miracle to dig the division out of this one. You can bookmark this, I predict that these numbers, particularly Cognac will look even more awful by the end of 2025. I believe there are some things coming down the line that if Alexandre and his team at Moët Hennessy simply ran some research on (or could even have McKinsey do it) before it completely blindsides them even though it is public info.

Getting into Jewelry and Watches, revenue was -1% and profit from recurring operations came in at -13%. I’ve written my thoughts in the past so not much else to say here and industry experts agree and also here. I’ll leave it to you as the reader to decide would you rather buy a top end TAG or entry-ish level Rolex? Would you pay 300.000€+ for this “watch” from Hublot?

On a positive note, for the company Selective Retail posted a 2% increase in revenue and profit from recurring operations up 12%. Selective Retail is comprised of DFS, Sephora and Le Bon Marché. I’d like to do some additional work here, especially on DFS (which is their duty-free retailer).

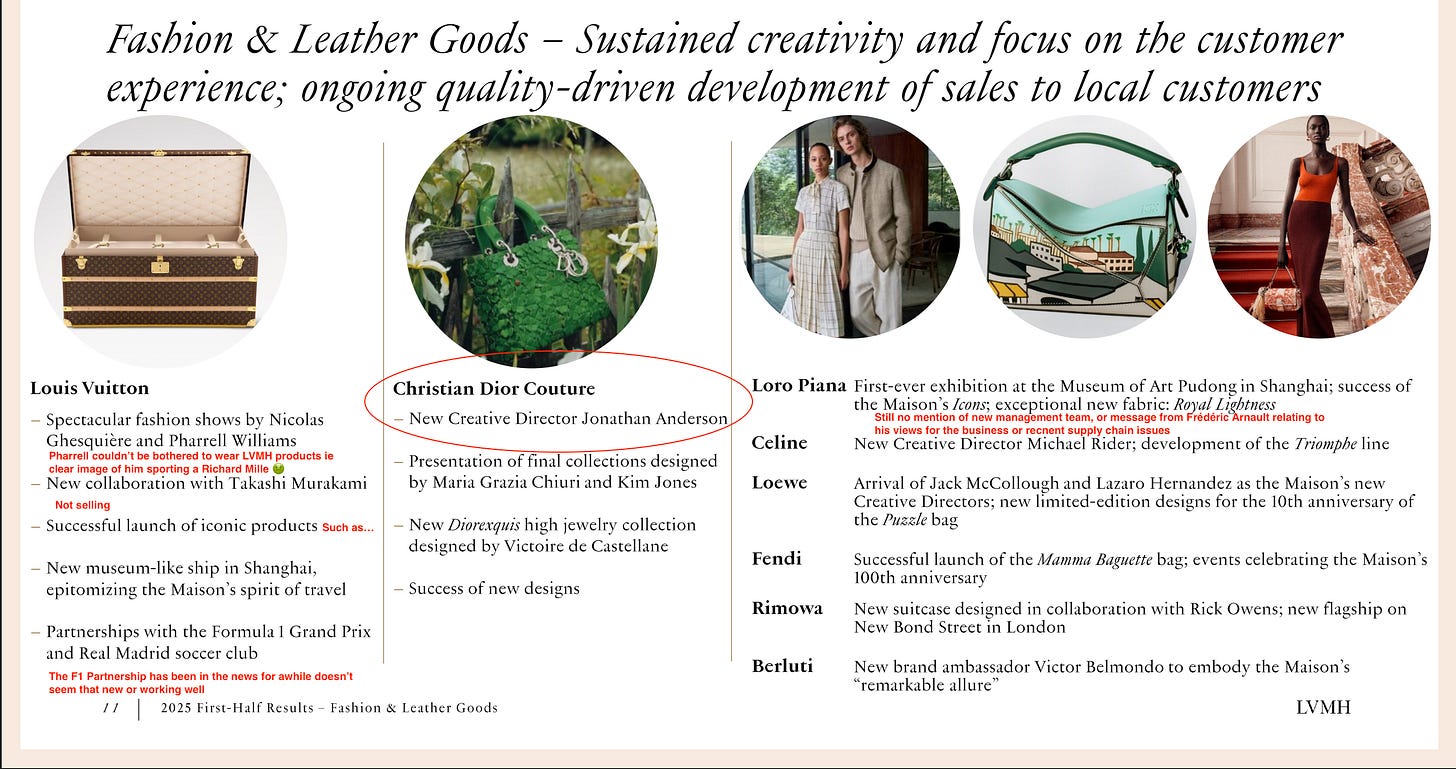

I will have some call transcripts with industry professionals in the wine, spirits and luxury industries to get their reaction to the numbers the LVMH put out. Lastly, I’ve included my notes on LVMH’s remaining “Outlook for 2025”.

If anybody at LVMH is interested in having a discussion I’m always happy to do so and it may be helpful seeing that I’ve been consistently accurate from piecing together publicly available information. Enjoy the last summer Friday in July and for those of you (like me) who are on holiday for August have an excellent time with your family and friends!

Over the past two years I have built a very strong track record on this and other names. This will most likely be one of the last fully “free” pieces that I put out. Intern Pierre has grown to be a Substack Bestseller and while it is certainly not a full time project for me, I do believe in making this type of information accessible, however not completely free. Professional investors have many upfront costs, Bloomberg Terminals, databases, a team to pull info and research providers like expert networks that we pay €200.000 annually to subscribe to. There is also the time factor. Based on the feedback I have received I believe that €5 on a month-by-month basis or €45 annually is more than fair for the value that can be unlocked and can be accessed by subscribing below. As always I’m happy to hear feedback!

Still short LVMH

Still long Kering

*I am an unpaid intern and an idiot. The article is my opinion and none of this writing should be considered investment advice. I may currently have or may take an investment position in the companies discussed. As always feel free to share your thoughts as I’m happy to discuss!

I didn't get to dial in so first of all thank you for this. If my Granny was still alive she'd have had Bernard belt the rest of the Arnaults with a sally rod (a pliable branch from a willow tree) across the back of the legs until their performance improved. What people don't seem to understand about LVMH including the young Arnaults themselves is that their customer base for the most part is the middle class - hence why TAG Heuers only Anthony Farrer would love aren't a great idea. Those brands that do aim higher have been dragged down by work practices that one wouldn't expect from Walmart nowadays. It almost makes Hugo Boss look well managed by comparison. One fact that really stood out to me is while the Arnault empire is on what Stephen Elop would have termed a 'burning platform'. Burberry was getting its first buy rating from analysts in 17 years.