The Art of Slowing Down

064: LVMH’s Moët Hennessy Struggles: A Test for the Next Generation—And a Warning for Investors

For investors in LVMH, the appointment of Alexandre Arnault as deputy CEO of Moët Hennessy should have set off alarm bells. While framed as an opportunity for the 32-year-old to prove himself in the looming succession battle, his arrival comes at a dire moment for the luxury group’s $6 billion wine and spirits business. With plummeting revenues, declining profits, and external economic threats mounting, the reality is clear: Moët Hennessy is in trouble, and LVMH’s response so far has been far from reassuring.

For some context, Moët Hennessy has been bleeding for two years, with 2024 operating profits crashing by over 33%. Cognac and Champagne—historically strong pillars of the brand—have seen demand shrink, forcing the company into deep discounting just to maintain its U.S. market share. Alexandre Arnault’s plea to “give us 100 days” to assess the situation underscores the fact that LVMH lacks a clear turnaround strategy, leaving investors to question whether this is a calculated transition or a desperate patch job.

In addition to declining demand Moët Hennessy, is once again caught in a web of contradictions—publicly claiming to have exited the Russian market while quietly profiting from indirect champagne shipments. Despite suspending operations in Russia in 2022, recent reports reveal that Moët Hennessy products continue to reach the region via third-party distributors. For investors, this should raise serious concerns about LVMH’s governance, credibility, and long-term risk exposure. LVMH’s response? "It’s impossible to control the final destination of a product marketed by a distributor." This excuse may seem plausible at first glance, but it is very questionable coming from a company that micromanages its brand image and retail strategies with military precision. If LVMH can orchestrate luxury experiences down to the last detail, why should investors believe it has no control over a critical geopolitical risk?

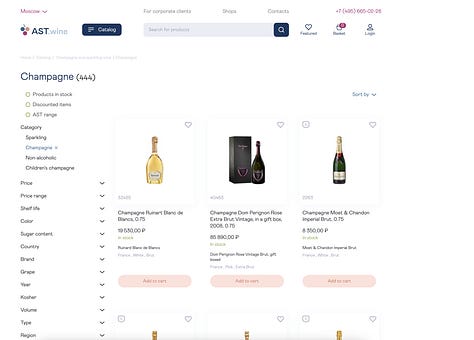

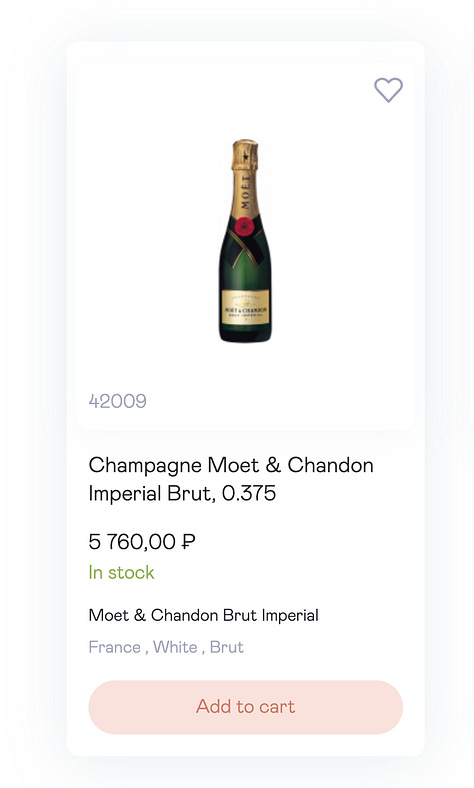

I thought this was interesting and have decided to dive deeper. AST which was a historical distributor for Moët Hennessy in Russia has active, in stock listings for Moët Champagne and Hennessy Cognac. This leads to the question how do LVMH products get to Russia?