The Art of Slowing Down

130: From Russian Shelves to Spanish Defects: Goldman Says Buy LVMH Anyway

Holy Christ run a channel check!

I was going to wait until tomorrow to send this out, however with Goldman Sachs adding LVMH to its European Conviction List, I thought my opinions would be of interest along with results from an in-store visit and surprise, LVMH products still popping up in Russia.

Earlier this morning, Goldman Sachs’ Louise Singlehurst added LVMH to Goldman’s European Conviction List. She recommended that investors "look through Q2 softness and Buy into LVMH" as it’s a clear winner in the next luxury upcycle, noting asymmetric risk reward with potential upside of 69% (nice!) versus 5% downside. Emerging catalysts include a new Dior Creative Director, and the LV beauty launch expected to support footfall. As a result, LVMH’s stock has popped around 3%.

If you’ve followed me for the past two years, you know that I strongly believe that the sell side is useless for a number of reasons. In this instance there are two glaring problems:

Q2 “softness” isn’t a one-off thing. There have been issues across brands that I have highlighted multiple times (here, here, here and here are a few examples). Had Goldman sent Analysts to a few stores without announcing who they were they’d realize that there are major problems with foot traffic, inventory buildup, number of SKUs and potentially IP (we’ll get to this in a minute).

Goldman Sachs (and the sell side in general) has a conflict of interest since while they are putting out ratings on various names, they are also vying for business to advise on deals. As an example Goldman Sachs was part of the deal where LVMH acquired Tiffany (they advised Tiffany). I would imagine they do not want to slap a downgrade on LVMH because a major part of LVMH’s model is to acquire companies, and it wouldn’t be in Goldman’s best interest to piss off the management of LVMH or potential target companies to be acquired. I understand that there is supposed to be a “Chinese Wall” but let’s be honest, do you really think that is enforced when there is a lot of money to be made?

I also think that Ms. Singlehurst is missing some other very important points. While yes, I believe Jonathan Anderson is going to do a fantastic job at Dior (his new collection looks great). It is not going to be enough to make up for issues within other parts of the company specifically, Moët Hennessy, Louis Vuitton and Tiffany.

If you haven’t read the transcripts from calls with industry experts, I would read through:

Former CEO of Van Cleef who can discuss issues that Tiffany may have

Former C-level executive with Audemars Piguet who can discuss the watch industry and why it will be difficult for LVMH to penetrate the market where companies like Rolex and Patek Philippe dominate

Once you’ve read through these you can form your own opinion on whether or not we’re seeing a little blip with “Q2 softness” or if there are other underlying issues that need to be addressed and will have a longer tail. I’ve taken advantage of the brief pop and have added to my short position.

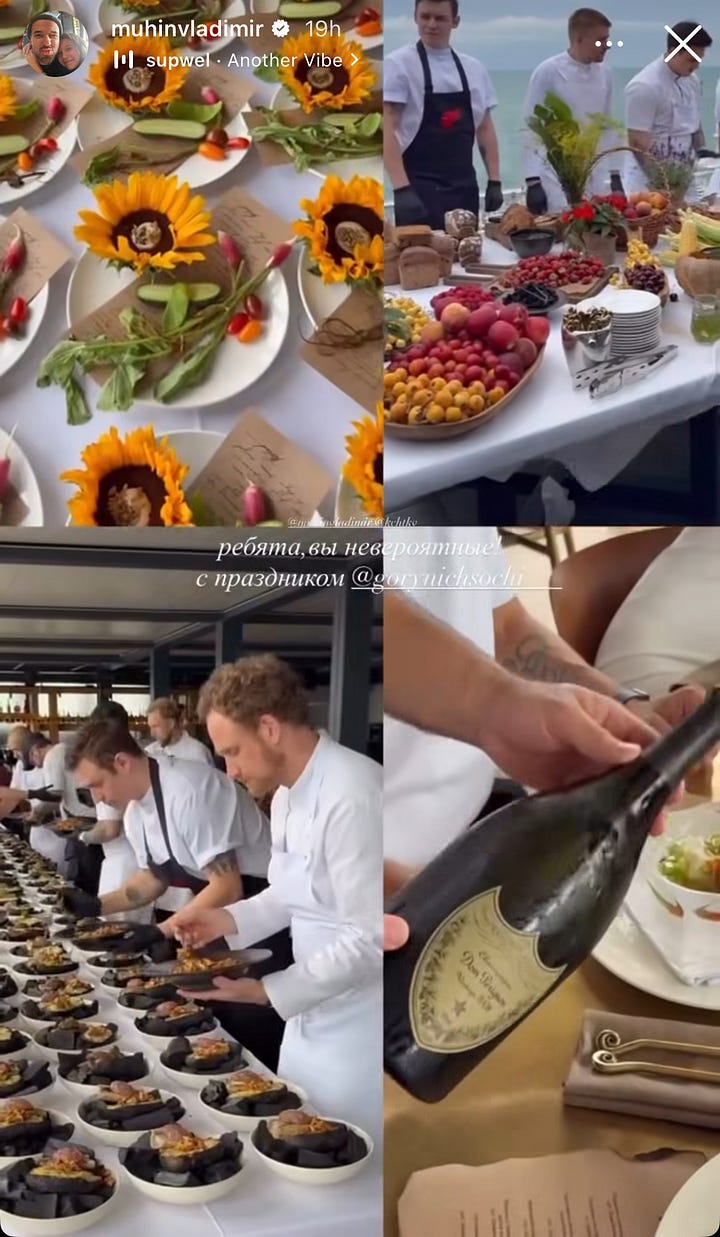

Before getting into my most recent store visit, I wanted to circle back on a piece I wrote in March relating to LVMH wines popping up in Russia. This subject came up again recently. I was having aperitivo with a few friends and the venue was crowded. Long story short, we had some open seats and let a few people sit at our table. One of those individuals completely by chance was Russian (now living in Europe) and had worked for LVMH in Russia. I (along with most other Europeans) think it is impolite to talk about work, however it came up organically since I was curious to learn about what living in Russia was like and how this person’s transition to Europe was going.

This individual mentioned that while LVMH had ceased operations in 2022, many employees moved to places like Dubai and keep in touch with former clients in Russia. What surprised me was when this individual said that along with wine, LVMH products were still available for sale in Moscow given that there is still high demand for luxury goods despite sanctions. This caught my interest, and I decided that it would make sense to do some research and verify what this person was saying.

What I found relating to wine and spirits wasn’t that surprising. Dom Pérignon is widely available in Russia as are brands like Moët.

It should be noted that other European wine labels produced later than 2022 can be found on the menus of various high-end restaurant ins Moscow, St. Petersburg and Sochi.

I was also able to access luxury “department” store websites like TSUM and GUM in Russia. If you try to access websites like TSUM you receive the following message:

Lucky for readers I’m not completely computer illiterate and I was able to get around this and wow! LVMH brands are listed all over the website. Again, it is important to note that you can also purchase products from brands like Rolex, Patek Philippe, Gucci etc.

LVMH has been quoted as stating that “it is impossible for us to track where our products end up”. My response to that is while yes, I would imagine most of these products are being shipped through some sort of third party that is buying them legally in the UAE, Turkey, Israel, Japan etc. I highly doubt you’re moving this kind of size without LVMH’s management knowing about it. This is the same company that sued a Portuguese spirits maker over a logo you cannot tell me they picked up on that but not a material amount of their products popping up in Russian stores readily available for sale.

According to “CEO Today Magazine” Bernard Arnault frequently visits “up to 25 stores per day (I doubt it) to evaluate inventory for discrepancies and imperfections.” He is also known for being very hands on and operates the company with “military level precision”. Ok so, I’m an unpaid intern so maybe I’m missing something here, but the company is saying they have absolutely no idea or control over where products end up once sold, however as an example you can sue Ebay for allowing resellers to sell real perfumes through “non-approved distribution channels”… ok.

Finally, I wanted to go through my recent store visit to Louis Vuitton.