Bain, McKinsey and the Boston Consulting Group (BCG) have been the subject of many jokes in the past few months. Most recently with HBO’s latest iteration of the “MAX” app leading many (including myself) to joke that “The Partner at Bain, McKinsey or BCG running this engagement must’ve gotten quite a nut from it”.

For those of you who are unfamiliar, Bain, McKinsey and BCG (MBB) are consulting firms that have created a model where C-Level executives at large companies can cover their ass and punt tough decisions to the consulting firms. If the suggested strategy doesn’t work the executives can blame the consultants and say, “it wasn’t our idea to gut the risk management team and fire 100 people, McKinsey told us to do it”. Hedge funds (Tiger Global famously spend $100m on Bain & Co to generate ideas and conduct diligence including DD on FTX) and Private Equity firms hire MBB consulting firms to help with due diligence or investment ideas.

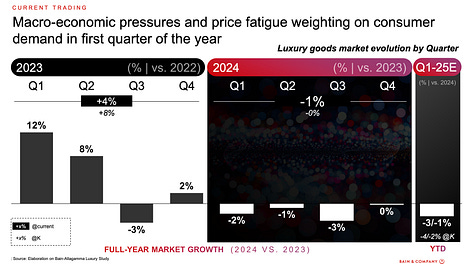

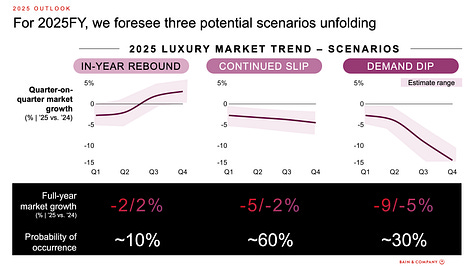

Yesterday, Wednesday May 14, Bain materially cut its 2025 sales forecast and I’ve included the deck that they posted on LinkedIn below as it looks like it was put together by an intern. They are now projecting a 2–5% decline in global luxury goods sales. This marks a major reversal from Bain’s previously optimistic estimate of up to 4% growth. No shit, Intern Pierre could have saved them a lot of work and a few million Euros in “research costs”.

The geniuses at Bain now cite “complex turbulence” across the sector, including price fatigue, weak creativity from brands, and mounting economic pressure in key markets like the U.S. and China. The hoped-for rebound in the U.S. consumer base is clearly faltering, and China’s luxury appetite is being crushed by ongoing real estate woes.

Bain’s report suggests consumers remain underwhelmed and are holding off on purchases—waiting for more than just overpriced, logo-driven releases. Meanwhile, post-pandemic price hikes, which many brands relied on to inflate margins, are now backfiring roughly half of the consumers who pulled back on spending cited excessive pricing as the reason.

Luxury executives once pinned hopes on resilience and brand loyalty, but with even Bain, the industry's preferred cheerleader (I’ll get into this in more detail shortly) ringing the alarm, the cracks are now impossible to ignore. Instead of delivering innovation, many brands are relying on status pricing and stale creative direction to prop up image but as I’ve mentioned in multiple pieces over the past year and a half, that model appears increasingly broken.

The reversal by Bain illustrates just how full of shit many of these “consulting” firms are. “Why is this, Pierre?” Well, let’s not forget who Claudia D’Arpizio, Federica Levato, Andrea Steiner and Joëlle de Montgolfier are working with or pitching as clients… That’s right large companies within the luxury industry! There is zero incentive for them to paint a less than rosy picture on the future of the industry unless, as we’re seeing now, they cannot deny it any longer. Stating in their “Bain-Altagamma Luxury Goods Worldwide Market Study”:

“Looking toward 2030, the market will likely embark on a long-term positive trajectory, with a growing addressable consumer base.”

“Looking ahead to 2030, we expect overall luxury spending (including goods and experiences) to experience solid growth of 5% to 9% per annum at current exchange rates, rising from an estimated €1.48 trillion in 2024 to an estimated €2 trillion to €2.5 trillion in 2030.”

“Beyond that, we expect solid market fundamentals to result in personal luxury goods market growth of 4% to 6% annually until 2030, reaching an estimated total value of €460 billion to €500 billion by the end of the period.”

These “opinions” are literally just a sales pitch. Companies will read this and say, “well if Bain thinks growth is the case to 2030 let’s hire them and make it happen”. 2030 is a generous target date and candidly many of the companies in the luxury space may not be around then if trends continue.

If I were an executive at a luxury company, I would undoubtably be reevaluating my reliance and spend on MBB consultants. These companies could get much more accurate data by working with firms that send teams to do site visits, interviews, high n targeted surveys (FYI MBB outsources this work to these firms and then 10x’s (allegedly) the cost to charge back to the client), specialized surveys (having people sit outside of various store locations and interview clients as they come in and out) etc.

I am generally not one to take a victory lap, however I have been shouting about many of these issues within the luxury industry, that MBB is now forced to highlight, for over a year. Since I am aware that there are many people who follow me (particularly LVMH) and subscribe to these pieces that work in the space, the offer still stands to help with getting accurate, usable data and insights without the bias you’re getting from the MBB firms.

Still short LVMH

*I am an unpaid intern and an idiot. The article is my opinion and none of this writing should be considered investment advice. I may currently have or may take an investment position in the companies discussed. As always feel free to share your thoughts as I’m happy to discuss!

Sorry only got around to commenting now as when I originally read this my laughing out loud and a sip coffee that I'd just drank had a disagreement. My phone got caffeinated in the process. I would also add a similar amount of 'witchcraft' going on with Morgan Stanley's annual watch report. If AT Kearney sets up a luxury practice run for the hills.